Great Travel Tool: Get a Credit Card with a Chip

We just started getting our replacement cards from Chase with the “Smart Chips” embedded in them:

What’s a “Smart Chip”

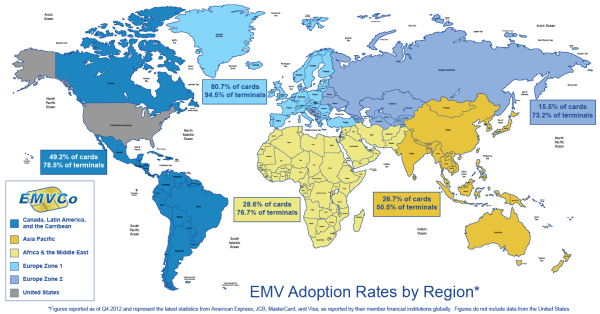

The “Smart Chip”, “Chip and Signature,” “EMV” or simply “chip” technology can be a live saver when traveling. While just now being introduced in the US, the payment technology is widespread throughout Europe and Asia.

Most retailers abroad have the option to use the chip or swipe with the antiquated magnetic strip, but many unmanned kiosks require a Smart Chip to be used. This might sound insignificant but you run into the self-serve kiosks more than you may think; you’ll use it for subway tickets, train tickets, bike rentals, vending machines etc… Take these for example:

Just about every European city these days has rental bikes scattered about. You’ll quite often be excluded entirely without a Smart Chip card.

Don’t believe me? Here’s a map with percentages of the world that have adopted the chip technology:

This is without mentioning that Smart Chips are said to be inherently more secure than magnetic strips:

“Smart Chip cards provide a higher level of security in some countries because the encrypted chip uses several measures that create a complex level of security, making a Smart Chip card difficult to copy or counterfeit.” -Chase.com

“Chip and PIN” vs “Chip and Signature”

The U.S. is quickly on track to broadly adopt the Smart Chip, but it’s still different than those that Europe and Asia typically use. Most of the cards offered by the U.S. are Chip and Signature cards– these are said to be less secure than Chip and PIN but still a step in the right direction. Be warned though: you might not have full compatibility when traveling abroad:

“As a result, such cards will not work on standalone kiosks for Chip and PIN cards, and also have similar increased vulnerabilities to the traditional magnetic swipe cards.” –Chip and PIN

Note: Chip and PIN doesn’t necessarily imply that one is a debit card and one is a credit card. The rest of the world uses the Chip and PIN for both credit and debit cards. The PIN is simply a higher form of security that uses a PIN code encoded into the chip for a higher level of authentication. This makes it much harder for the card to be used if stolen.

Where to Get One

The only US bank offering a true Chip and PIN card is USAA (and you must be eligible to join). The feature is only available on certain MasterCards they offer.

Here are a few of the major US credit cards that are already offering a Chip and Signature card (and have no foreign transaction fees!):

- American Express Platinum/Business Platinum

- Bank of America (BankAmericard Travel Rewards)

- Barclaycard / Bank of Hawaii (Hawaiian Airlines Card)

- Chase (British Airways Visa, Hyatt Visa, Marriott Rewards Premier, Ritz-Carlton Rewards, Chase Sapphire Preferred)

- Citi (Hilton HHonors Reserve, Citi ThankYou Premier, Citi Prestige, AAdvantage Executive, Platinum, Gold, Citi Simpliciy, Citi Forward etc…)

If you’re looking for a prepaid debit card, the Travelex Multi-Currency Cash Passport might not be a bad choice. It offers Chip and Pin security and flexibility, but charges a 5.5% foreign transactions fee! They’ll also hit you up for $3 every month the card is inactive.

BOTTOM LINE: There’s decent chance you already have a credit card that offers a Smart Chip, all you have to do is call and ask for a replacement! But, if you don’t, I highly suggest getting one with $0 annual fee and 0% foreign exchange fees–it will make your life much easier while traveling abroad.