Credit Score Crash Course

One of the most useful tools in traveling the world for free is airline frequent flyer miles and hotel points. The quickest way to rack up enough miles/points for free travel is by signing up for credit cards. In the past few years, credit card companies have been getting more and more aggressive for your business and offer huge incentives in the form of signup bonuses if you apply for and are approved for their card. This can easily be to the tune of 50k to 100k airline miles in certain programs, which can often equate to 1 or 2 free roundtrip flights to anywhere in the world. Before you dive in, you’ll need to understand a few things, namely about your credit score.

So, a little lesson on your credit score (as I understand it–no sympathy will be given for taking my non-expert financial advice and having something go wrong for your situation):

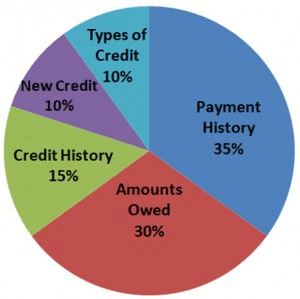

This is an approximation on how your credit score is calculated:

Credit Utilization -30%

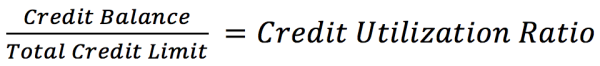

One worry for some is that having too many credit cards can ding your credit score when in fact, the opposite is often true. This is because on of the biggest factors that goes into determining your credit score is “credit utilization.” This is factored by adding your total credit card balance (your statement balance every month) across all of your credit cards divided by your total credit limit:

You want to keep this as low as possible, without going to 0%. I personally shoot for the 5-10% range, but anything under 30% considered great. The best thing about this is that it can be manipulated, and manipulated quite easily. Remember, what the credit agencies are reporting isn’t a credit balance in the sense that many people think of it–it is your statement balance. So, if you have 1 credit card with a $1,000 limit and put all of your monthly expenses on it, say $990/month then your statement balance will be $990, a credit utilization rate of 99%. Even if you pay this balance off before the due date and never day a penny on interest the key metric, your credit utilization rate, will always be 99%.

The key in gaming, or manipulating, this number is to pay down your credit card a few days in advance of your credit card statement date. In the above scenario, I would send my credit card company about $950 about 2 days before the statement runs. This way, my statement would show that I am carrying a balance of $50, or 5% of my credit limit and, as a result, my credit score would improve.

This gets us back around to how opening a new credit card could possibly help your credit score. Let’s say that a bank was offering a credit card with a 50,000 frequent flyer mile bonus for signing up… they’ve got my attention and I want it. If I apply for the card and am granted a $2,000 credit limit, now my overall credit limit increases from $1,000 to $3,000, so that, when I carry a total statement balance of $50 per card, my credit utilization rate is now $100/$3,000 or just 3% = A likely improvement in my credit score.

Key take away: always prepay your credit card a few days before your billing cycle ends.

Key take away: always prepay your credit card a few days before your billing cycle ends.

Payment History – 35%

The biggest factor that drives your credit score: Payment History. In fact, Credit Utilization and Payment History account for ~65% of your overall credit score.

Payment History, however, is an obvious one. Pay your bills on time and you’ll have no problem. Again, adding a credit card is no risk here.

Account History – 15%

Age of credit history: This one can’t necessarily be manipulated but needs to be considered when opening and closing credit cards. The key factor here is average age of accounts. So, yes opening an additional card will, by definition bring you down a bit here, but only marginally. The thing to keep in mind is that there is an incentive to keep your oldest card active and not cancel it because it is bringing your average up the most.

New Credit Applications – 10%

This is another that will ding your score if you’re playing the credit card signup/miles game. It’s really just a cost of doing business. Here’s more on how it will affect you, from myfico.com:

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender.

Hard inquiries are inquiries where a potential lender is reviewing your credit because you’ve applied for credit with them.

For many people, one additional credit inquiry (voluntary and initiated by an application for credit) may not affect their FICO score at all. For others, one additional inquiry would take less than 5 points off their FICO score.

So the risks are pretty low–they’ll typically ding you for 2-3 points for every hard inquiry. In perspective, if you have an excellent credit score of 770, a 2 point decrease will bring you down by ~0.2%–a small fraction.

Types of Credit in Use – 10%

How they actually calculate this one is a bit of a mystery to me but basically 10% (a very small amount) of your credit score is calculated by assessing the different types of credit account reported on your credit report. Typical examples include:

- Credit cards

- Retail charge card account

- Mortgage loans

- Automobile loans

- Other finance company accounts

This is another area where having credit cards, and using them responsibly, could actually improve your credit score:

Having credit cards and installment loans with a good payment history will raise your FICO Score. People with no credit cards tend to be viewed as a higher risk than people who have managed credit cards responsibly.

But as with all else: everything in moderation. Having 8 credit cards and 0 other accounts will reflect poorly on your credit score.

BOTTOM LINE: Before starting to play the credit card miles/points game, you must have an understanding of how you credit score is calculated. In my experience, applying for credit cards to take advantage of the large miles signup bonuses has actually improved my score because I always make sure my credit utilization is low and that I actively manage each card.