How-to Guide: Taking a Trip For Free!

For those of you saying, “Enough already! How do you get started?” here’s a quick crash course on racking up the points required for a free trip. This is written from the perspective of someone with no frequent traveler points that is starting from scratch.

1. Understand your credit score

This is imperative to getting in on the free miles game. Start by reading our Credit Score Crash Course post here. This will give you an idea of what is behind your credit score.

2. Look up your credit score

Before going any further, figure out what you’re working with. Please don’t go to just any website for a credit report– there’s a reason that the FreeCreditReport.com guys can afford all of those TV ads and catchy jingles: they’re making a ton of money off of the uninformed consumer. Here are 3 great sites that are reputable, legitimate and free (none of the sites will ask for a credit card!):

- AnnualCreditReport.com – This is THE site for free credit reports. In fact, “Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion® – once every 12 months” and this is the site that provides it. Note: it provides credit reports, not credit scores.

- CreditKarma.com – Provides an approximation of your FICO score based upon data from TransUnion.

- Credit Sesame – Provides an approximation of your FICO score based upon data from Experian.

Your FICO score is typically what most lenders will use to judge your credit worthiness — but unfortunately isn’t free. You can order a report from the official FICO agency on their website, myFICO.com, but it will cost you and probably isn’t worth it–the 3 sites above should give you ample data to make an informed decision.

Once you’ve reviewed your credit and feel that you’re in good enough financial health to open a credit card (or 2), you can start shopping the current bonus offers.

3. Shop for big-bonus credit cards

Credit cards want your business. They stand to make a lot of money off of you by collecting the 2-3% service fee they charge to vendors, and even more if you end up carrying a balance. This means large sign-up bonuses for credit card products from different banks and card issuers.

How do I find the deals? Good question, we regularly post about credit cards being offered with an attractive sign-up bonus. Alternatively, you can reference NerdWallet.com: Reward Cards for a list of all the cards being offered. We’ll get your started with the best credit cards on the market today:

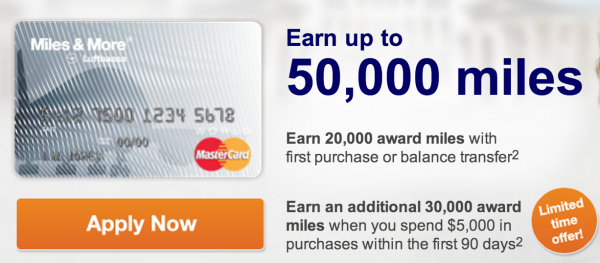

- Lufthansa Premier Miles & More Mastercard = 50k miles – more info here

- This card will give you enough miles to for a free round-trip flight in economy from the U.S to Europe.

- Chase Cards

- Chase Sapphire Preferred = 45k points – more info here

- Ink Bold Business Card = 50k points – more info here

- Ink Plus Business Card = 50k points – more info here

- All of the above Chase cards let you earn Ultimate Rewards points, which transfer directly to United & British Airways (and a host of others, but your best option in the USA will be United):

- Points needed for a flight: the 50k bonus you receive will put you very close to a round-trip flight to anywhere in the world. Here’s what it costs in points to different areas of the world:

- 35k to Central America/Caribbean

- 40k to Northern South America

- 60k to Europe and Southern South America

- 70k to North Asia, Japan and Oceania

- United MileagePlus Explorer Card = 50k miles – more info here

- See above for how far United can take you; it might be a good idea to apply for both the Chase Sapphire Preferred and the United MileagePlus card so that you’ll have 100k miles to work with. If you’re headed to Oceania for 70k miles, you could then use the remaining 30k Ultimate Rewards points to book a few nights at a Hyatt hotel while on your trip.

- See above for how far United can take you; it might be a good idea to apply for both the Chase Sapphire Preferred and the United MileagePlus card so that you’ll have 100k miles to work with. If you’re headed to Oceania for 70k miles, you could then use the remaining 30k Ultimate Rewards points to book a few nights at a Hyatt hotel while on your trip.

- United MileagePlus Explorer Business Card = 50k miles – more info here

- US Airways MasterCard = 40k miles – more info here

- The 40k won’t get you as far as the other offers, but if you have a trip envisioned in a few months, if might be a good idea to apply for both the this US Airways MasterCard and the AAdvantage card below. When US Airways and American Airlines continue their merger later this year, you’ll be able to transfer points seamlessly between the 2 programs, yielding a total of 90k miles.

- If you’re willing to travel at “off-peak” times, you can squeeze a good bit of value from the 40k US Airways miles. For example, the U.S. to Europe or South America from Jan 15 – Feb 28, 2015 is only 35k miles.

- Citi Platinum Select / AAdvantage World MasterCard = 50k miles – more info here

- At the “MileSAAver” rate, you can travel from the U.S. to Japan/Korean for just 50k miles!

- At the “MileSAAver” rate, you can travel from the U.S. to Japan/Korean for just 50k miles!

- British Airways Visa Signature Card = 50k miles – more info here

Disclaimer: I’m an idiot and haven’t signed up for the referral to make any money off any of the above credit card offers. This is this genuine advice as I see things. I have most of the cards listed above and will be applying for the rest in the next few weeks. However, take my advice with caution: I’m far from an expert on financial/credit matters, but happy to help where I can.

4. Dream big and book your travel

Plan ahead! All of the above credit card offers can take anywhere from 2 to 10 weeks from signup to having the points hit your account so make sure you have plenty of lead time.

The programs that you’ll be confined to booking through will all depend on the currency of points you plan to acquire in step 3. My tip is to keep your options as wide open as possible and start with a currency that is transferable to many programs. An example would be any card (Chase Sapphire Preferred, Ink Bold, Ink Plus) that earns Chase Ultimate Rewards points. This will give you flexibility to use your points for either hotels (Hyatt, Marriott) or flights (United, British Airways, Southwest….) and is a good start for beginners. Keep in mind that any points not put toward your flight can be transfered to hotel points.

Here are a few of the guides we’ve written about using points– should be helpful for getting a gauge of where you can go most easily/for the least amount of points:

- British Airways: US Airways Flights: Using British Airways Avios out of Charlotte-CLT

- British Airways: How-to: Book US Airways Flights With British Airways Avios

- British Airways: Ultimate Honeymoon: The Caribbean for Free with British Airways Avios

- British Airways: Caribbean Island Hop with British Airways Avios (only 4,500 points/flight!)

- Hyatt, Marriott: Paris, France: Best Hotels for Free Using Points –> Spoiler alert, the answer is: Park Hyatt Paris Vendôme Hotel Review – Paris, France

- Delta: How-to: Use Delta SkyMiles to Book an Award Ticket to Europe: Searching Availability

- Delta: Ultimate Honeymoon: Thailand with Delta Skymiles

- United: All about our Turkey–Istanbul/Cappadocia–and Portugal Trip

- United: Award booking with United miles to Istanbul/Cappadocia, Turkey and Lisbon, Portugal

- United: Ultimate Honeymoon: French Polynesia with United miles

- United: Ultimate Honeymoon: Thailand with United miles

And, please comment below if you have any questions about where to go/how far your miles can take you–we’re happy to help!

Other travel-related necessities to help you plan: